- Pet insurance: Do I need it to provide financial security for myself and my pet?

- Introduction

- What is pet insurance?

- Types of Pet Insurance: An Overview

- Detailed look at health insurance for pets

- Why take out pet insurance? Practical insights and examples

- Reasons for pet insurance

- Everyday cases from the veterinary practice

- Important aspects when taking out pet insurance

- Decisive criteria for choosing pet insurance

- Frequently asked questions about pet insurance

- Germany - animal insurance - developing country

- Practical tips: What to do in the event of damage?

- Why we recommend Smartpaws as pet insurance

- Summary of pet insurance

Pet insurance: Do I need it to provide financial security for myself and my pet?

Introduction

In today's world, when medical care for pets is becoming more advanced and therefore more expensive, pet insurance is no longer a luxury but a necessity. This article offers you an in-depth look into the world of pet insurance, explains its importance and shows you how to find the best coverage for your beloved pet.

What is pet insurance?

Pet insurance is similar to human health insurance and covers medical expenses resulting from your pet's illness or accident. This insurance is particularly important because it protects you from high financial expenses that may arise from veterinary treatments.

Benefits of pet insurance

- Financial Relief: You can avoid high, often unexpected veterinary costs that would represent a significant financial burden without insurance.

- Better Medical Care: With pet insurance, you don't have to choose between financial feasibility and the best treatment available for your pet.

- Peace of Mind: Knowing that your pet's health is taken care of gives you peace of mind.

Types of Pet Insurance: An Overview

Choosing pet insurance is an important step in ensuring the health and well-being of your pet. Different types of insurance offer different coverages that may be tailored to your pet’s specific needs. Here is an overview of the most common types of pet insurance:

1. Pet health insurance

Health insurance covers the cost of your pet's medical treatment in the event of illness or health problems. These include, among other things, the costs of examinations, medication, inpatient stays and surgical procedures.

2. Accident insurance

This insurance is designed to cover the costs that arise from accidents, such as traffic accidents or injuries while playing. It is particularly important for active animals that spend a lot of time outdoors.

3. Combined accident and health insurance

Combined insurance offers comprehensive protection against both accidents and illness. This is the most comprehensive insurance option, covering both accident-related and illness-related treatment costs.

4. Life insurance for pets

Although less common, life insurance for pets also exists. These usually pay out a sum if the animal dies or is stolen. Such policies are more commonly found on very valuable animals or on animals that are professionally bred.

5. Liability insurance for pet owners

This type of insurance covers damage your pet may cause to others. This is required by law in many countries, especially for dog owners, but can also be useful for other animal species.

What should you pay attention to?

- Scope of coverage: Check carefully what the insurance covers and what services are excluded.

- Deductible: Many insurance policies require a deductible for every claim. The amount of the deductible can vary greatly.

- Premium costs: Compare the costs of different insurance policies to find the best deal.

- Age limits and health checks: Some insurance companies have age limits or require health checks before taking out the contract.

Understanding these different types of insurance will help you make an informed decision that best suits your pet's needs. Well-chosen pet insurance can not only provide you with financial security, but also help ensure your pet lives a long, healthy life.

Detailed look at health insurance for pets

Pet health insurance can come in a variety of forms depending on the level of protection you want for your pet. Here we differentiate between surgical insurance, full insurance and pure health insurance without preventive services. Each of these options has its own benefits and specific features.

1. Surgery insurance

Surgical insurance is a specialized form of animal health insurance that focuses on covering the costs of surgical procedures. This type of insurance is ideal for pet owners who want to protect themselves against the high costs of surgical treatments without paying for the more comprehensive coverages of full insurance.

Advantages:

- Covers surgical procedures and associated medical costs such as anesthesia and hospitalization.

- Usually cheaper than full insurance.

Disadvantages:

- Does not cover non-surgical treatment costs, such as medications or outpatient treatment.

2. Full insurance

Comprehensive insurance provides the most comprehensive coverage by covering both surgical and non-surgical medical treatments. This includes regular check-ups, vaccinations, medications, laboratory tests and more.

Advantages:

- Comprehensive protection for a variety of health needs, including preventive measures.

- Offers security through broad coverage of a wide range of medical situations.

Disadvantages:

- Higher premiums than more specific insurance options.

3. Pure health insurance without precautions

This type of health insurance focuses on covering costs arising from acute illness or injury. Preventive measures such as vaccinations or regular health checks are usually not included.

Advantages:

- More cost-effective than full insurance because it only covers treatment costs in the event of illness.

- Good option for pet owners who are able to cover routine and preventive costs themselves.

Disadvantages:

- No coverage for preventative treatments, which may ultimately lead to higher overall costs if preventive measures could prevent illness.

Choosing the right health insurance depends heavily on your individual needs and those of your pet. Surgery insurance can make sense if you primarily want to cover high surgery costs. Full insurance offers the most comprehensive protection, but is associated with higher costs. Pure health insurance without preventative care is a cost-effective solution if you are primarily looking for protection in the event of illness and can finance preventive measures yourself. It is important that you make your choice on a well-informed basis to ensure the best possible care and financial security for your animal.

Why take out pet insurance? Practical insights and examples

Having pet insurance can provide numerous benefits and can prove essential when it comes to supporting your pet during emergencies or health issues. Here we explain some key reasons why pet insurance is a smart decision and illustrate them using three everyday cases from a veterinary practice.

Reasons for pet insurance

1. Financial security

Veterinary costs can quickly add up, especially when specialized treatment or emergency surgery is required. Pet insurance helps cover these costs and protects you from financial stress.

2. Access to better medical care

With insurance, you don't have to hesitate to seek the best treatment available for your pet. You can provide quick and comprehensive medical assistance without worrying about the high costs.

3. Peace and security

Knowing that your pet is covered in the event of illness provides peace and security for you as a pet owner. You can rest assured that your pet will receive the care it needs in the event of an illness or accident.

Everyday cases from the veterinary practice

Case 1: Torn cruciate ligament in a dog

A dog suddenly becomes lame while playing in the park. The vet diagnoses a torn cruciate ligament – a common injury in active dogs. The necessary operation, including aftercare and physiotherapy, can quickly cost several thousand euros. Animal insurance covers these costs, enables optimal treatment and supports the rehabilitation process.

Case 2: Diabetes in a cat

An older cat will show symptoms such as increased drinking and urination. The vet diagnoses diabetes, a chronic disease that requires lifelong treatment, including regular blood sugar checks and insulin administration. The ongoing costs of medications and regular checkups can be a financial challenge that pet insurance can alleviate.

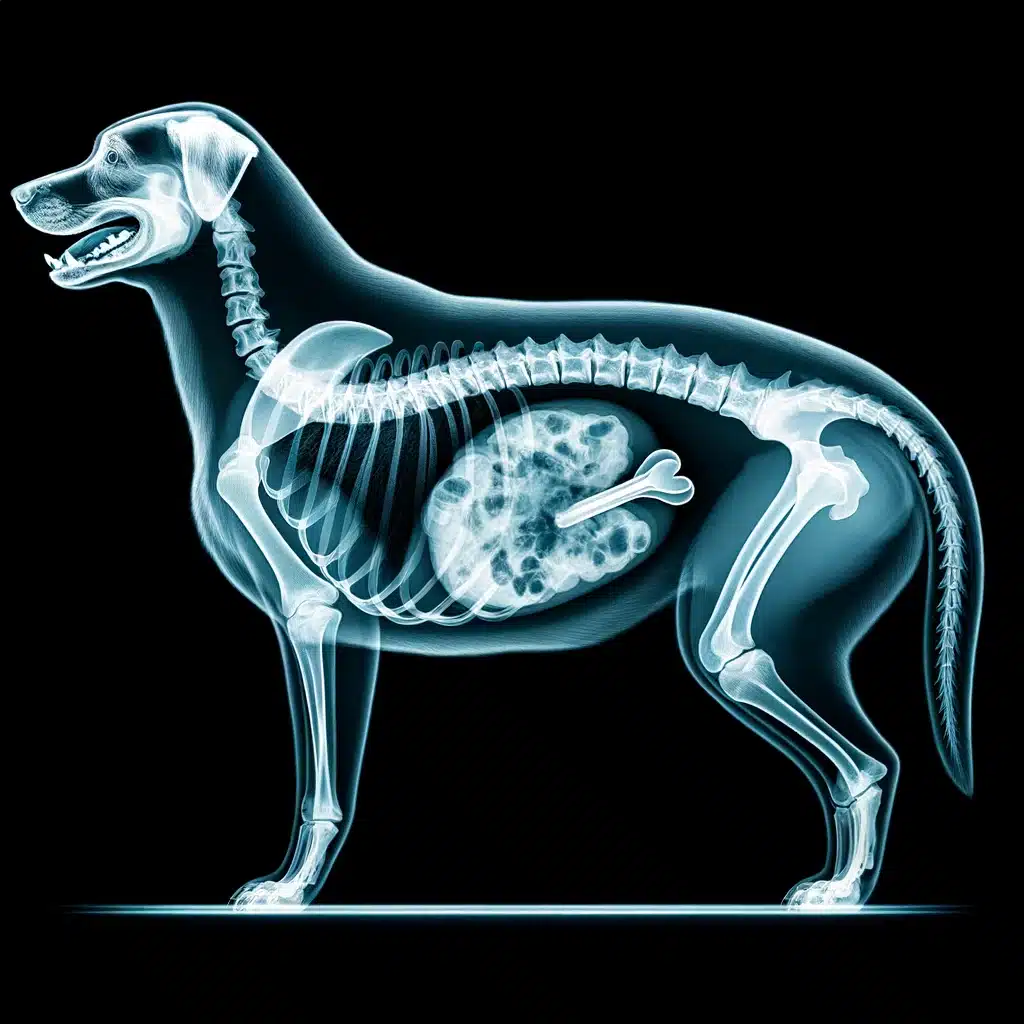

Case 3: Foreign body consumption by a dog

A dog accidentally swallowed a toy part that cannot be excreted naturally. Urgent surgery is required to remove the foreign body and avoid potential life-threatening complications. Such emergency surgeries are costly and can occur unexpectedly, significantly increasing the financial burden without insurance.

Important aspects when taking out pet insurance

1. Understand coverage

It is crucial that you understand exactly what your insurance covers. Typically, costs for emergency treatment, diagnostic tests, surgical procedures and medications are covered.

2. Deductible and maximum amount

Most insurance policies require you to cover part of the costs yourself (deductible). In addition, there is often a maximum amount that the insurance company pays per year or per incident.

3. Exclusions and Limitations

Find out about possible exclusions. For example, many policies do not cover pre-existing medical conditions or specific breeds.

4. Comparison of providers

Compare offers from different insurers in terms of price, performance and customer service. This will help you find the best option for your needs.

Decisive criteria for choosing pet insurance

Frequently asked questions about pet insurance

What does pet insurance typically cover?

Pet insurance covers a variety of medical expenses that may affect your pet, depending on the insurance plan you choose. The most basic insurance policies cover emergency treatment, surgery and related medications. More comprehensive plans may also cover costs for diagnostics such as x-rays or ultrasounds, regular health checks, vaccinations, dental treatments and even alternative therapies such as acupuncture or physical therapy. It is important that you carefully review the policy details to understand what benefits are included and what are not.

Why should I insure my pet as early as possible?

Insuring your pet as early as possible has several benefits. Young animals are generally healthier, and many insurance policies do not provide coverage for pre-existing conditions. By insuring your pet at a young age, before it develops any health problems, you can enjoy comprehensive protection, without the limitations of previous medical conditions. In addition, the premiums for younger animals are often cheaper and the animal can remain insured without interruption throughout its entire lifespan.

Is there a deductible for pet insurance?

Yes, most pet insurance policies have a deductible. The deductible is the amount that you as a pet owner have to pay before the insurance begins to cover costs. This can be set as a fixed amount per year or as a percentage of the total costs. The amount of the deductible and the way in which it is calculated can vary greatly depending on the provider and the tariff chosen. A higher deductible usually leads to lower monthly premiums, but also means higher costs in the event of a claim.

What should I do if my pet gets sick or has an accident?

In the event of an illness or accident involving your pet, you should first seek immediate medical attention from a veterinarian or emergency clinic. Inform the veterinarian that your animal is insured and clarify what form of treatment and diagnostics is necessary. After initial care, it is important to contact your insurance company as quickly as possible to report the damage and clarify details about coverage. Be sure to have all invoices, reports, and other documents you receive from the veterinary practice as you will need to submit them to settle the claim.

How can I choose the right pet insurance for my pet?

Choosing the right pet insurance requires thorough research and comparing different offers. Take into account not only the costs, but also the extent of the coverage. Consider your pet's risks and needs, for example due to its breed, age or living conditions. Read customer reviews and ask your veterinarian for recommendations. Pay particular attention to the details of the policy terms and conditions, such as coverage limits, deductibles, included and excluded benefits, and any waiting periods. A direct comparison of the services and costs of different providers can help you make an informed decision that will ensure your animal's long-term well-being.

Germany - animal insurance - developing country

The prevalence of pet insurance varies significantly between different European countries. Here are some insights into what insurance rates look like in selected European countries:

Sweden

Pet insurance is particularly common in Sweden. It is estimated that about 80% of dogs and 50% of cats are insured. This makes Sweden one of the countries with the highest pet insurance rates in the world. This is due, among other things, to a long tradition of animal protection and a high level of awareness of animal health.

Great Britain

Many pets are also insured in the UK. It is estimated that around 25% of pets are insured. There are a variety of providers in the UK and pet insurance is a well-developed market offering comprehensive insurance options.

Germany

In Germany, around 15% of dogs and less than 10% of cats are insured. Pet insurance is becoming increasingly popular here, especially in urban areas where awareness of the benefits of pet insurance is growing.

France

In France, the pet insurance market is growing, with approximately 6% of pets insured. French pet owners are increasingly beginning to recognize the importance of the financial protection that pet insurance offers.

Italy and Spain

In southern European countries such as Italy and Spain, pet insurance rates are still relatively low. Less than 5% of pets are insured. The low prevalence can be partly explained by lower veterinary costs compared to other European countries and a less strong insurance culture.

The differences in the prevalence of pet insurance across Europe reflect different cultural attitudes towards animal ownership and care, as well as different economic conditions. Countries with higher veterinary costs and a strong awareness of animal welfare are more likely to have pets insured. However, interest in pet insurance is increasing in many European countries as more pet owners recognize the potential financial risks associated with caring for a pet.

Practical tips: What to do in the event of damage?

Vet visit

If your animal has an accident or becomes ill, you should consult a veterinarian immediately. He will initiate the necessary initial measures and make the diagnosis.

Contact insurance

After visiting the vet, it is important that you contact your pet insurance company as soon as possible. Inform them about the incident and clarify whether the planned treatments are covered.

Documentation is crucial

Have all receipts and medical reports ready. These are needed to make a claim with your insurance company.

Why we Smartpaws as pet insurance

When it comes to protecting and caring for our beloved four-legged friends, choosing the right pet insurance is crucial. Smartpaws stands out as an excellent option, particularly with its specialized approach and inclusive policies. Here are some reasons why Smartpaws / doc4pets insurance could be the ideal choice for covering your dogs and cats:

Focus on the essentials

Smartpaws offers pure health insurance that is specifically designed to provide support in the event of illness or surgery. This specialized insurance does not cover the cost of routine preventive care such as vaccinations or expensive dental treatments. This means pet owners can be confident that their premiums will go directly toward protecting them against high unexpected costs caused by serious health problems or necessary surgical procedures. This makes Smartpaws particularly attractive to owners who are on a budget and want to focus on protecting against major financial risks.

No age discrimination

Another significant advantage of Smartpaws is the ability to accommodate pets even at older ages. Dogs and cats can be newly insured up to the age of 8, which is not the case with all insurers. This is particularly valuable because older animals require medical care more often, making insurance a great help in dealing with the associated costs.

Fairness in claims

Smartpaws is characterized by fair claims settlement. Regardless of the amount of costs incurred, animals are not excluded from the insurance. This gives pet owners additional security and confidence as they can be confident that their insurance will remain in place even in the event of repeated or high levels of damage. This policy underlines Smartpaws' commitment to providing ongoing support rather than pursuing short-term financial interests.

Smartpaws offers a targeted and cost-effective solution for pet owners who want to focus on serious health risks without the distraction of additional routine preventive services. The inclusion of older animals and the fair handling of claims make Smartpaws a recommended choice for every responsible pet owner. If you are looking for reliable, focused and fair pet insurance, Smartpaws is an excellent choice.

Summary of pet insurance

Pet insurance is an essential tool for minimizing the financial risks associated with pet healthcare. Choosing pet insurance can be complex, but well-chosen pet insurance provides peace of mind and peace of mind that your pet will be well cared for in the event of illness. Pet insurance typically covers the costs of unexpected illness or accidents, although the exact terms may vary depending on the pet insurance policy.

Having pet insurance means not having to choose between financial burden and your pet's health. With pet insurance, pet owners can also take advantage of expensive treatments such as surgeries or special medications without financial concerns. The importance of pet insurance becomes particularly clear in emergencies, when quick action is required and the costs of emergency operations or intensive treatment are covered by pet insurance.

Animal insurance is not only financial protection, but also a form of precaution that puts the animal's well-being first. By taking away many of the worries about coverage, pet insurance allows pet owners to focus on the recovery and care of their pet. Many pet owners see pet insurance as an integral part of responsible pet care.

Choosing the right pet insurance requires careful consideration and comparison of the different offers. Pet insurance should be chosen carefully to ensure it covers your pet's specific needs. When choosing pet insurance, it is advisable to consider both the amount of coverage and the amount of the deductible. Pet insurance can include different services depending on the tariff and provider you choose.

When it comes to pet insurance, it is also important to pay attention to the details of the policy, especially restrictions and exclusions. Pet insurance often offers different tariffs, which can differ in scope and price. Therefore, it is important to choose pet insurance that offers good value for money. Comparing pet insurance and considering reviews from other pet owners can also be helpful in making the best decision.

Ultimately, pet insurance is an investment in your pet's health and well-being. Pet insurance not only protects against unforeseeable costs, but also gives you the security that your pet will receive the best possible care in the event of illness or accident. Pet insurance is therefore an essential part of pet ownership for anyone who wants the best for their pet.